News

Summers Will Not Finish Semester of Teaching as Harvard Investigates Epstein Ties

News

Harvard College Students Report Favoring Divestment from Israel in HUA Survey

News

‘He Should Resign’: Harvard Undergrads Take Hard Line Against Summers Over Epstein Scandal

News

Harvard To Launch New Investigation Into Epstein’s Ties to Summers, Other University Affiliates

News

Harvard Students To Vote on Divestment From Israel in Inaugural HUA Election Survey

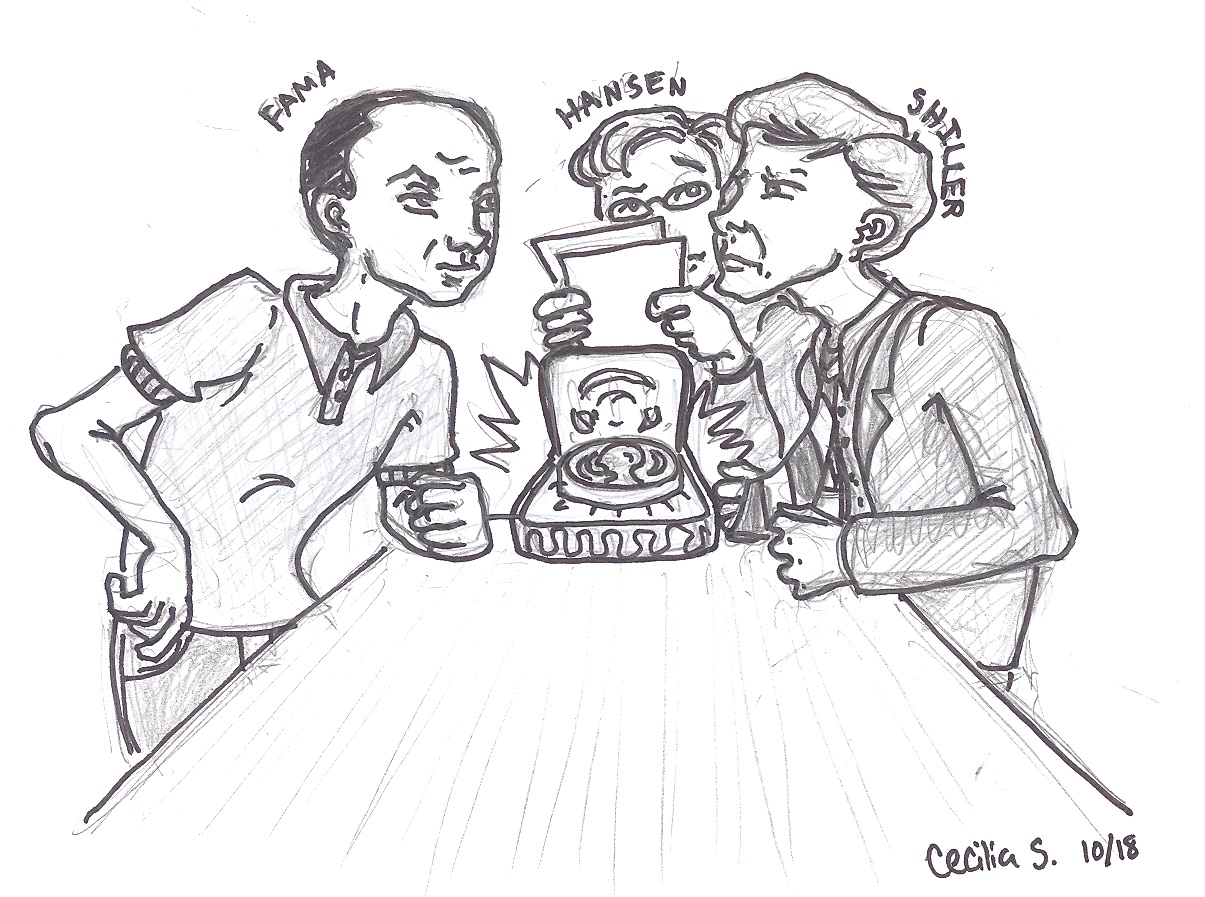

Monkeys and Darts

This year's laureates represent a diverse cross-section of economic thought

It’s an old jibe against the economics profession that no two economists will agree with one another. It’s an old jibe against the stock market that stock pickers can do no better than a monkey throwing dart at the stocks page. It was perhaps based on these convictions that the Nobel Prize Committee decided to award the prize to three financial economists who can’t agree on, you guessed it, whether the market can do better than a monkey throwing dart.

The contentious issue here is the efficient market hypothesis, a theoretical construct that it is impossible to consistently predict the direction of the market. Economists and practitioners had long suspected the randomness and unpredictability of the stock, but it was Eugene Fama, one of the laureates, who first formalized and empirically tested the idea in the 1960s. Fama first debunked the chartists, exemplified by Charles Dow of Dow Jones fame, who claimed the ability to predict future price moves based on past prices. Fama also showed that stock prices respond very quickly to new information. These facts suggest that it would be hard and expensive, if not impossible, to predict price movement based on past information.

While Fama demonstrated that short term stock price movements are not predictable, another laureate, Robert Shiller, showed that they are over the long term. The Nobel Prize Committee cites his 1981 paper that revealed stock price movement to be much more volatile than changes in dividend values. Since stock price should be equal to the expected value of all future dividends, stock prices seem to be excessively volatile compared to the intrinsic worth of future dividends. This result leads to predictability in price movement—if stock price rose relative to dividend, it is likely that such divergence is due to volatility in stock prices rather than expected value of dividends, and one can predict that price will revert back to levels justified by the dividends. Shiller believes that short term unpredictability cannot so swiftly imply market rationality in face of such evidence, calling efficient market hypothesis “one of the most remarkable errors in the history of economic thought”. Rather, he prefers to describe financial markets as overrun by irrational exuberance and animal spirit. He attributes his fascination of these “human follies” to his wife who is a psychologist. Shiller’s research inspired a new, booming subfield of economics called behavior finance that aim to find markets irrationality due to such human follies.

On the other side of the debate, Fama is no stranger to predictability in the stock market. His “three factor model” of stock return can predict price movements based on simple metrics such as firm size and price-to-book ratio, a model widely accepted by the finance community. But Fama prefers to interpret market predictability as a consequence of rational decisions. Specifically, prices change with investors’ appetite for risk. In general, people are wary of risk, and riskier assets have lower prices and higher expected return to compensate for their undesirability. In a good economy, people are more comfortable holding riskier assets, so price of riskier assets, such as stocks, soar. In a bad economy (think the financial crisis circa 2008-2009), people are more risk-averse as the economy creates more uncertainty, and they will not buy stocks even given the cheap price. Rationalists like Fama hypothesized that variation in stock prices reflects the variation in people’s desire to hold riskier assets, which is a rational concern for investors.

Thanks to the third laureate Lars Hansen’s research in econometrics—the economists’ arsenal of mathematical and statistical tools—Fama’s hypothesis can be tested against historical data. Hansen’s main contribution, the Generalized Method of Moments, allows economists to write down complex economic models and estimate model parameters with nice statistical properties. It also allows economists to focus on their parameter of interest, usually a simplified parable of the entire model. This powerful tool quickly became a standard and integral part of introductory econometrics (admittedly, a part that leads to head scratching among students, myself included). Although Hansen’s research is less interpretable to the general public, it probably leaves the greatest mark on economics as an indispensable tool to connect models with empirics.

In 1982 Hansen tested Fama’s hypothesis to estimate the link between risk and asset price, and the data showed that appetite for risk alone cannot explain fluctuations in asset prices. In the vacuum of a conclusive theory, behaviorists offered psychological explanations such as herd mentality and forces of habit. Behaviorists also suggested that institutional arrangements, such as compensation structure for asset managers, can lead to irrational asset pricing.

The fight between “rationalists” and “behaviorists” is far from over, and the answer is likely a mixture of many theories. It is reasonable, then, for the Nobel Prize to be awarded to thought leaders at both camps. In their fight for truth, the laureates greatly expanded our empirical understanding of asset prices. They justly deserve the prize, as the official announcement states, for their empirical analysis of asset prices. The market may behave like a dart-throwing monkey, but this year’s Nobel laureates helped us understand the beast much better.

Jonathan Z. Zhou ’14 is an applied mathematics concentrator in Eliot House. His column appears on alternate Fridays.

Want to keep up with breaking news? Subscribe to our email newsletter.