News

Summers Will Not Finish Semester of Teaching as Harvard Investigates Epstein Ties

News

Harvard College Students Report Favoring Divestment from Israel in HUA Survey

News

‘He Should Resign’: Harvard Undergrads Take Hard Line Against Summers Over Epstein Scandal

News

Harvard To Launch New Investigation Into Epstein’s Ties to Summers, Other University Affiliates

News

Harvard Students To Vote on Divestment From Israel in Inaugural HUA Election Survey

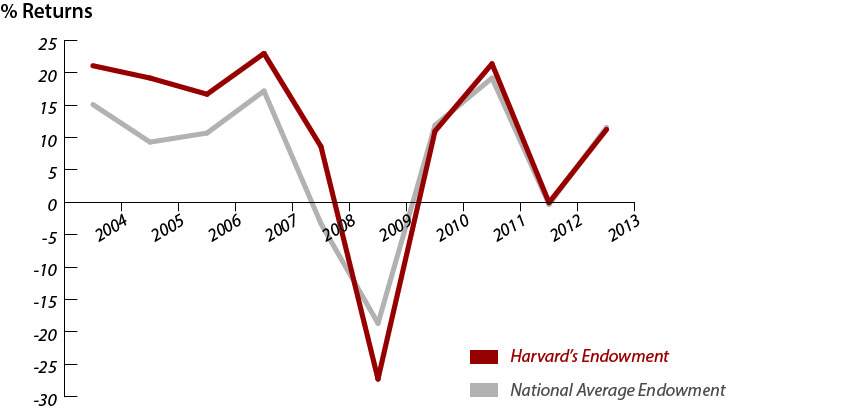

Endowment Growth Trails National Average, Report Shows

Harvard’s endowment grew at a slower rate than the national average for American colleges and universities, as well as many of its peer institutions, in fiscal year 2013, according to data released Tuesday by the National Association of College and University Business Officers and Commonfund Institute.

In each of the past ten years, Harvard’s endowment has outperformed the NACUBO average and remains the most valuable of the 835 schools that participated in the survey at more than $32 billion. This year, however, the average NACUBO school saw returns of 11.7 percent, while Harvard’s endowment grew by 11.3 percent.

In a letter accompanying the University’s FY 2013 financial report, which was released in November 2013, Harvard Management Company President and CEO Jane L. Mendillo celebrated the 11.3 percent return, which she wrote exceeded the HMC’s “policy portfolio benchmark.”

“As we have noted previously, earning returns in excess of the markets as represented in the Policy Portfolio is not easily done and is not expected every year,” Mendillo wrote.

Universities commonly set such benchmarks to reflect individual long-term priorities and risk-management strategy. During the financial crisis in FY 2009, Harvard’s endowment lost nearly $11 billion in value—falling to $26 billion from $36.9 billion in FY 2008. Since the financial crisis, Mendillo has emphasized risk management strategies in investing as the endowment has slowly recovered.

Kevin Galvin, a University spokesperson, reiterated HMC’s commitment to outperforming its internally set policy portfolio benchmark.

"At HMC, the primary goal is to beat the benchmark policy portfolio, which is calibrated to meet the long-term needs of the University's research and education mission. Our 11.3 percent return in fiscal [year] 2013 exceeded our benchmark by a healthy 213 basis points and contributed about $600 million of additional value above the markets,” Galvin wrote in a statement Tuesday evening. “Our focus remains on outperforming the markets allocated by our policy portfolio.”

Harvard also drained more funds from its endowment than many of its peers, drawing $1.5 billion dollars, or 5.5 percent of the endowment, to fund University operations in 2013. The NACUBO average endowment payout rate for institutions with endowments over $1 billion was 4.8 percent in FY 2013.

This year, Harvard was outpaced by the rest of the Ivy League, where University of Pennsylvania’s 14.4 percent endowment return led a strong year of collective investing for the eight-school conference. Yale, Brown, and Dartmouth also had returns over 12 percent, and Columbia and Cornell finished with 11.5 percent and 11.4 percent returns, respectively. Stanford also outperformed Harvard, finishing with 12.1 percent investment growth, while MIT matched Harvard at 11.3 percent.

—Staff writers Christine Y. Cahill and Amna H. Hashmi contributed to the reporting of this article.

—Staff writer Matthew Q. Clarida can be reached at matthew.clarida@thecrimson.com. Follow him on Twitter @MattClarida.

Want to keep up with breaking news? Subscribe to our email newsletter.